Навигация

Value appraisement of real estate in pledge

2.2.2. Value appraisement of real estate in pledge

The mortgage gives the creditor the right to collect and to sell the property of the borrower in the case of non-payment of indebtedness in the time of fulfillment of the obligation. That it is necessary to estimate the value of the property of the borrower more correctly, chousing more appropriate methods of a valuation.

Accordance with the legislation of the Russian Federation upon agreement of the mortgagor and the mortgagee (observing the provisions of Article 67 of Federal Law “ On Mortgage” in the event of mortgage of a land plot); the appraised value shall be stated in the mortgage agreement in monetary form.

The parties to the mortgage agreement may entrust appraisal of the subject of mortgage to an independent professional organisation.

Value appraisement of real estate in pledge depends on thee factors: real estate prime cost, profitability and location. Taking into consideration foreign experience in hypothecary crediting in value appraisement of real estate mainly three methods can be used: expendable method, comparative method and profitable method. Expendable method is based in studing investors’ possibilities in buying real estate in this case one must take into consideration that the prudent investor would not pay for the object a higher price than the price which he could pay if he taken the appropriate land for development and for constructing the analogical building in function and quality and without great delays in near future.

This method is useful for our country. It can be used if there is not enough information about comparative sales that is this method can be in passive markets. At the same time using of the expandable method as the main method in value appraisement of real estate stimulates a sharp rise in prices of real and it doesn’t give real market value of the object.

In value appraisement of real estate of the market value of the building the building is compared with analogical buildings soft before, which actual market value is well know. But in this case we must take into consideration a number of factors correcting the value appraisement. These factors are location of the building, ecological situation, remoteness of the industrial works, closeness of health and cultural centers, communication network. The value appraisement depends also on architectural peculiarity, the style of building, the type of construction, the disposition of the rooms, hidden defect in building. The problem of value appraisement is finally decided by modeling as market price is in the base of the value appraisement. /13/

After obtaining of the loan the borrower bears the responsibility for safety of the building in pledge and measures for maintaining of the building. These measures are repairs in time, fire insurance, insurance against natural calamities for bank interest, refusal against reconstruction or fortifying of the building without the permission of the bank and using of the properly for illegal activity.

2.2.3. The sole order of real estate registration.The mortgage system cannot function without the sole for all the country order of registration of objects of real estate, including dwelling, land, pledge sheets.

At the present time the registration of real estate is based on the separation of the land from other property connected with it. The consequence of such situation is registration of different types of real estate in several state organizations. That is necessary to consider the experience of foreign country. The original mortgage begins then when the creditor independently on his location can receive reliable information of position of the real estate which he is interested in, including information of previously made mortgages or rent agreements independently on location of the client.

The agreement on mortgage should be attested by a Public Notary and is subject to State registration. It is put in force from the moment of such registration.

Table 5

Certification by a Notary and State Registration of Mortgage Agreement

| Elements forms of agreements | Requirements |

| Certification By a Notary | Mortgage Agreement shall require certification by a notary |

| If an agreement lacks any data mentioned in Article 9 of the present Federal Law or if the rules mentioned in Item 4 of Article 13 of the present Federal Law are violated, then such agreement shall not be subject to notarisation as a mortgage agreement. | |

| Non-observance of rules on notarisation of mortgage agreement shall lead to its nullity. Such agreement shall be considered null and void. | |

| . If a mortgage agreement states that the mortgagee's rights in conformity with Article 13 of the present Federal Law shall be certified by an encumbrance, then such an agreement shall be submitted to a notary along with the encumbrance. A notary shall state the time and place of notarisation of the mortgage agreement on the encumbrance as well as number and stamp the sheets of the encumbrance in keeping with second part of Item 3 of Article 14 of the present Federal Law. | |

| State Registration of Mortgage Agreement | Mortgage Agreement shall be subject to state registration. |

| If an agreement lacks any data mentioned in Article 9 of the present Federal Law or if the rules mentioned in Item 4 of Article 13 of the present Federal Law are violated, then such agreement shall not be subject to state registration as a mortgage agreement. | |

| Non-observance of rules on state registration of mortgage agreement shall lead to its nullity. Such agreement shall be considered null and void. | |

| Mortgage agreement shall be considered concluded and shall enter into force since the moment of its state registration. |

The mortgage system cannot function without the sole for all the country order of registration of objects of real estate, including dwelling, land, pledge sheets. The attempts of administrations of separate regions to establish in the purposes of acceleration of mortgage introduction the local rules of such accounting can lead to the variety incompatible with meaning of mortgage and cause negative consequences. At the present time the registration of real estate is based on the separation of the land from other property connected with it. The consequence of such situation is registration of different types of real estate in several state organizations: committees on land resources and land-tenure regulations, bureau of technical inventory , committees of direction of state property, housing committees. Each of these bodies realizes registration of rights for land, buildings, constructions, living houses and premises in accordance with its rules. Imperfect accounting of real estate raises doubts with respect to lawfulness of transaction of sale-purchase, mortgage, and leads to abuses. In such conditions it is impossible to provide protection of commercial interests of legal person and individual in the case of transaction with real estate.

The participants of Business Club of the journal “Law”, discussing the question of establishment of market economy in the part of regulation of real estate by the Russian legislation, decided, that the absence of mechanism of registration of mortgage agreement transferred all market of real estate in the hands of officials, who nobody knew, who could paralyze, distort every law, or put the fulfillment of the law in dependence on their decision, and this is the first condition of transformation of legal business into criminal business.

Besides, in the case of estimation of application concerning registration of mortgage of real estate, it is necessary to take into consideration that the law admits repeated mortgage of real estate to different persons and at the same time establishes the principle of seniority.* It consists of the fact that each person whose right appears earlier, will get the first the satisfaction of his requirements from the amount received from the sale of the mortgage object. Accordingly each later holder of mortgage will receive only the rest which is left after full satisfaction of requirements of previous holders.

It means that in the case of the decision of the question if it should grant credit under collateral or enter into other obligation covered by collateral, the future mortgage holder should take into consideration the fact if the property offered as collateral has already been mortgaged, and if yes so what will be the volume of the requirement assured by the mortgage.

On the strength of novelty of the questions, which concern registration and appearance in connection with this of the whole range of vagueness it is necessary to consider the experience of foreign countries, where the systems of real estate registration are rather strictly developed.

In the countries with developed market economy the registration of real estate has considerable meaning. It is considered as the base of market functioning. The real estate registration is effected in two systems: the system of transactions registration and the system of rights registration. In the first case the documents, which confirm fulfillment of transaction, shall be registered and

* Item 1 article 342 of Civil Code of Russian Federation

filed in special books in chronological order. This system is typical for majority of the states of the USA, England and the range of other countries. In this system the main factor is registration of rights of property, which shall be realized under the agreement between previous and new owners.

The first owner is obliged to check the ground of his rights for the land. The new owner who is interested in the fact that the transaction was assured against faults, shall hire special firm, legal company, which examines the whole history of property on this land or the object of real estate for the period of 70 years. It is made in the purpose to find out if there are any circumstances or unknown previous owners who can have any rights for this land or the object of real estate. This type of the registration system has imperfection , which , in accordance with general opinion, consists of the fact that the system cannot give the purchaser of real estate or the creditor all necessary information and makes them to suffer considerable losses, necessary for inspection of content of registered documents.

In the second case the rights for real estate are registered. In this case any actions are subject to registration, which concern the stated rights. The advantage of such registration consists of the fact that the participants of the market of real estate have the possibility to receive necessary information from appropriate body without extra expenses. This system of registration is named Central-European and is the most popular in the world and presumes that the right of property is guaranteed by the state. There the lands and the objects of real estate are subject to the state registration in the land book in which the full and exact information of real estate is introduced. It is established for these purposes that all registered rights for coming into power must be introduced into land book. The guarantee of completeness and rightness of information of real estate is the most precious thing for this system. It can be reached by introducing into land book of information which is the most substantial for the characteristic of the legal position of real estate. First of all the rights of owners shall be registered, and also the lease of mortgage; the rights, appeared on the strength of other transactions; the rights of using of real estate by other persons than the owner /servitudes/, for instance the rights of establishment of boards with advertisement , the right of passage, different burdens /fees, arrests, court decrees/, mutual using particularly in condominiums. The enormous advantage of this system is the possibility to restore without additional expenses the history of owners of real estate objects. /9/

The bright proof of the role of Central Europe system is fixation of keeping of land book not only in the national legislation of separate countries, but also in the international acts. So the obligation of the state for keeping of land book is stipulated in the paragraph of the first article of the first additional protocol of European convention on human rights .

In accordance with the opinion of A. Lazarevskiy/ the head of the Division of the methodical assurance of the State Committee of property of Russia/, the above-mentioned system of registration when the state guarantees the rights of property, undoubtedly is cheaper than the registration of transactions. Exactly Russia needs such system. “From our point of view – he says – the first task is the creation of the sole for our country system of registration. First, we need register of objects of real property as physical objects, with statement of strict borders of the land on the location, with statement of physical parameters of constructions, and the second register – it is the register of legal rights of owners for this real estate. Second, the registration of legal rights separate from the first registration is necessary. In this case the land shall be considered not as a physical object, but as a range of rights for using of land in the permitted limits. The rights for change of using, sale, mortgage – all these rights shall be enumerated in the land book, and also the restrictions.

All the owners shall be named in the chronological order from the moment of registration of the object of real estate. The administrator – representative of the state, that is registering body, must guarantee reliability of realized operations. The observations and recommendations of doctor Otman Shtekkor /Union of the German mortgage banks/ are devoted to the problem of the real estate registration. He thinks that for issuing mortgage credits it is necessary both loan-contractual right and legislation of mortgage and land books. In the case of creation of system of land books it is very important to determine in good time the reasons of land registration. It is also important to provide that the registration records were full. The purchaser of property must entrust the correctness and completeness of records. Every interested person shall have the possibility to get quickly et not expensively reliable information of legal situation on land. Excessively high tariffs of the land-book administration and notary will only provide deviation from registration and lead to roundabout transactions. It is especially important that the information of land-survey will be in strict conformity with the records of owner rights in the land –book, that the identification of the lands and the establishment of their legal status can be realized in every time. /8/

The law “On pledge” stipulates one more type of registration of real estate – keeping by the mortgagor of the book of mortgage recording. In this case the mortgagor is obliged not later than ten days after appearance of mortgage to introduce in the book record of the type and the object of mortgage, and also the volume of liquidity of the obligation assured by the collateral. The mortgagor must bear responsibility for opportune and correct introduction of information of mortgage into the book and also for deviation because of incomplete and insufficient information from presentation of the records book for examination.* However, the stated norm does not work. The Civil Code does not stipulate the obligation of mortgagor to keep book of mortgage recording, and only establishes, that mortgagor is obliged to inform every next pawnee of all existed mortgages of this property and to be responsible for expenses, caused to pawnee by non-fulfillment of these obligations.** The absence of the norm of keeping by the mortgagor of the book of mortgage recording in the Civil Code can be possibly explained by the fact that this

* Article 31 of the law “On Pledge” of the Russian Federation on 29 of May, 1992 N2872-1

* * Item 3 of the article 342 of the Civil Code of Russian Federation.

question shall be resolved by the law “On mortgage”. However, the law “On mortgage” does not contain either such norm, and it is omission of legislator. In my opinion the law “On mortgage” shall contain norm of obligation of mortgagor to keep the book of mortgage recording or the book of registration of mortgage into which the mortgagor is obliged not earlier than ten days after appearance of mortgage to introduce information of type, object of mortgage and the volume of liquidity of obligation assured by collateral, and to present it for examination to every interested person. Besides it is necessary to stipulate also responsibility of mortgagor for inopportune keeping of records in the book of mortgage registration, for incompleteness or incorrectness of records and also for deviation from duties to present the book of mortgage registration to the interested persons.

The original mortgage begins there and then where and when the creditor independently on his location can receive reliable information of position of the real estate which he is interested in, including information of previously made mortgages or rent agreements independently on location of the client.

The mortgage presumes registration of mortgage transactions in standard order by the sole body in narrow connection with legal practice, court, arbitration court, in this result the possibility of repeated mortgage is excluded. The functioning of this system is impossible without creation of the unified general base of information of mortgaged real estate. In this it is its main difference from systems, which are based on separate information, published in different newspapers and advertisement editions, which do not bear responsibility for reliability of proposed information. This problem can be decided with help of central network of computer communications.

2.2.4 Insurance – important element decrease of credit risks.Carrying out of mortgage operations is as well connected with definite risks, to which refer risk of loss (destruction) or damage of the subject of gage etc. Insurance allows considerably reduce this kind of risks.

The legal basis for insurance of mortgage operations are the norms contained in the Paragraph 3 of the Chapter 23, and also in the Chapter 48 of the Civil Code of the Russian Federation, Law of the Russian Federation from November 27, 1992 No 4015-1 “On organization of insurance business in Russian Federation” and Federal Law from July 16, 1998 No 102-FЗ “On mortgage (gage of the real estate)” (hereinafter referred to as “law on mortgage”).

Article 343 of the Civil Code of the Russian Federation stipulates that the pledger or pledgee depending on who of them has gaged property, is obliged, if other is not stipulated be the current legislation or agreement, to insure gaged property at expense of the pledger. The same provisions are contained and defined in a more detailed way in the Article 31 of the law on mortgage. Provisions of this law say, that insurance of the property gaged in accordance with agreement on mortgage, is conducted pursuant to conditions of the indicated agreement. Thus, in case of absence in the agreement on mortgage of other conditions on insurance of the gaged real estate, the pledger is obliged to insure this property at his own expense for a total cost from risks of losses and damages, and if the total cost of the property exceeds the size of the backed liabilities – for the sum not less than the sum of these backed liabilities. /7/

As a rule, the beneficiary according to agreement on insurance of real estate being subject of the gage, is nominated the pledgee, that is the creditor under liabilities, backed with the gage. However and in cases, when the gaged property is insured for the benefit of other persons (for example, for the benefit of the pledger), for the purpose to protect interests of the pledgee - creditor, the pledgee has right to satisfy claims under liabilities backed with the mortgage directly from insurance indemnity paid in case of loss or damage of the gaged property. The indicated requirement is subject to satisfaction on priority basis before satisfaction of claims of other creditors of the pledger and persons, to whose benefit is carried out insurance.

If pursuant to the terms and conditions of the agreement of insurance the gaged property is insured for the sum lower than the total cost of property, than in the case of insured accident which has entailed loss or damage of insured property, insurance company reimburses to the pledgee only part of losses calculated proportionally to ratio of the sum of insurance to full (insurance) cost of the gaged property. Insurance agreement may stipulate a higher size of insurance indemnity, but not exceeding the full (insurance) cost of property. The indicated provision referring to so-called incomplete property insurance, is stipulated in the Article 949 of the Civil Code of the Russian Federation.

Insurance of gaged property is one of important terms and conditions of agreement on mortgage. Pursuant to the Article 35 of the law on mortgage if the pledger does not fulfill his responsibility to insure the gaged property, the pledgee has right to require advance fulfillment of liabilities, backed by the mortgage, and if such demand will not be satisfied, the pledgee has right to impose collection on the gaged property.

Chapter 3. The problems and the perspectives of mortgage crediting.

3.1. Foreign experience of mortgage creditingThe examination of the world experience of mortgage credit organization shows, that this market has considerable potential.

The mortgage banks appeared for the first time in Germany in XVIII century. The first mortgage bank was the state bank, founded in Silesia in 1770 for rendering financial support to large landowners. At the beginning of XIX century the activity of mortgage banks extended on the small landlord properties, and then on the peasant lands. In the middle of 60 years of XX century there were in Germany 13 state and 25 private land banks. The control package of shares of majority of the banks belonged to large banks.

In other countries there is no similar strict system of mortgage banks. So in the USA in 1916 the land banks were organized in 12 districts for issuing long-term loans under collateral of land. At the present time the mortgage credits in the USA are granted on the whole by loan-savings associations, mutual-savings banks and small farmers banks, which have regional meaning. /6/

In Canada the mortgage banks are engaged on the whole in crediting of operations with real estate. At the beginning the object of their activity was crediting of agriculture under collateral of land and agricultural constructions, and then – in principle housing construction.

In France the biggest land bank (“Crédit fonds de terre de France “ ) and its affiliate “ Office of businessmen ” (“ Comptoir des entrepreneurs ”) grant credits to landowners and construction companies for housing and production construction. Mortgage operations are realized also the bank of land crediting (French land bank) which was founded in 1853. The bank credits on the whole the large construction for the period from 3 to 20 years.

In the European countries, as Finland, Sweden, Belgium, Holland there are both private and state mortgage banks. So in Finland the private banks grant mortgage credits. Real estate serves as collateral – land and constructions, both production and non-production. The banks mobilize more than 70% of means by issuing of mortgage bonds. In Sweden four mortgage banks function which are under state control. They are engaged in crediting of housing construction, agriculture, shipbuilding, and also trade. In Belgium the special credit organizations realize operations of granting long-term loans, which form so-called state credit section. This section consists of Central department of mortgage crediting, which loans are guaranteed by the state. In Holland the mortgage credits are granted by agricultural credit institutions, organized on cooperative basis. They are unified by the Central cooperative peasant bank (Rabobank).

There are mortgage banks in some developing countries (Argentina, Mexico, Nigeria and others).

Now we will consider some distinctive features of organization of mortgage crediting in developed countries. The experience of these countries in this sphere to some extent can be used in the conditions of Russia.

For the countries of Romanic German right (The whole Western Europe, except Denmark) the similar regime of mortgage is typical: notary certified act, land-survey or land book, publications of mortgage ant other essential formalities.

The registration of mortgage is realized by state officials ( in the countries with land book – by the judge). He registers all acts of law of estate on transactions with real estate (sale, purchase, servitude , privileges and others) and also forms real and personal card-index. With his help it is possible to receive real picture of mortgage and privileges with respect to real estate. All these factors permit creditor to be convinced of the fact that:

the mortgage property really exists in acts (with help of land-survey or land book);

the property is not mortgaged (with help of card-index of registration or judge).

Without above-mentioned services it is impossible to create good functioned safe mortgage system. Otherwise great difficulties may appear for organizations which grant loans.

If the creditors do not have strict idea of mortgaged property, they can suffer losses because of the reason that such property did not exist. Moreover because of the fault in records, which should be kept in strict chronological order, the creditor can lose his preferential right, which will be transferred to other creditors./8/

In other countries the conception of mortgage is more flexible and less formalized , especially in the countries of English Saxon right with regime “Equity & Common Law”. Particularly there is no necessity in naturally certified act, and mortgage can bear general character, that is the object of mortgage is not emphasized or the publication is absent. Two above-mentioned systems are used in Denmark.

Why in the case of availability of rich own experience before revolution and possibility of using of the experience of developed countries the mortgage in our country did not occupy adequate place?

The claims on this question can be made to all participants of the market – borrowers, creditors and the state. And even first of all to the state, because till now the favourable legal base was not created, by no means the creation of the secondary market is stimulated. The latter is very important. Many economists think , that this is secondary market which will become kernel round which the whole structure will begin develop. Four level similar system (and rather effective) already exists in the USA, in which federal agency of mortgage crediting is introduced as a additional element in chain between links “the state” and “mortgage bank” – it is to some extent the agent of federal government. And there are several such agents in the USA – Federal National Association, Federal Homebuilding Loan Mortgage Corporation, Federal Land banks, created for crediting under mortgage of farming lands and , which act in accordance with the principles of above mentioned associations, and others. All these organizations represent original areas on which the present segment of the securities market functions. Receiving the guarantee from the government these associations buy the pledges from private financial institutions. In their turn the monetary means come to associations from the sale of own securities. The profit received from the trade of these securities is invested to great extent to the homebuilding and in this manner the retrospective link is effected. /6/

Thus the importance of existing of such associations is determined by those functions, which they realize: development of standards of mortgage crediting, assistance in support of liquidity of banks through refinancing of some types of credits, issuing of own securities for attraction of new investments in the sphere of homebuilding. It is necessary to note that this section of the market of debentures is the largest in the world in accordance with the volume of attracted capital.

The examination of the world experience of mortgage credit organization shows, that this market has considerable potential. It is important that it help to resolve one of the most sharp social question – providing the population with dwelling.

3.2. The problems. The first steps of organization of mortgage crediting In Russia.Mortgage crediting – to great extent new for our country type of banking services, and there are serious obstacles, which impede its development. The main obstacles are insufficient normative legal examination of the question, complication of attraction of long-term resources for mortgage, estimation of different types of risks and payment solvency of borrower. All these problems impede considerably development of mortgage in Russia. However nobody doubts that it will be used in all parts in the future.

The organization of the system of long-term homebuilding mortgage crediting in Russia becomes complicated because of some circumstances. The high and unstable rates of inflation determine potentially important risk of interest rates in the case of long-term crediting. The risk of homebuilding crediting, connected with the possibility of using of home property as a collateral, increases also because of insufficient legal examination of the question of possibility for the bank of making claim on mortgaged property of the client in the case of nonpayment of the credit by the borrower. The genuine experience of mortgage operations does not exist, and 1500 commercial banks, which function now, form bad controlled and not very reliable system.

However, in spite of all problems, some process in development home crediting is reached for all that. The interest of the banks to these operations can be explained, first, by existing already now of real solvent demand on long-term home loans and , second, by foresight in the future of the large market for mortgage credits, and understanding of the fact, that now it is possible to occupy good position for receipt in the future of the share on this market.

The creation full legislative normative base will provide the passage to the civilized forms of mortgage crediting, to the mass development of mortgage. As we already noted the result of large and difficult work was adoption by the State Duma of the law of Russian Federation “On mortgage”. From the point of view of association of mortgage banks the adopted law on the whole is in conformity with the purposes and the tasks of development on the legislative basis of civilized mortgage of home crediting. However this law is ideal, it can be tested by the practice, by life.

The difficult position was formed in the practice of mortgage crediting in the agricultural section. The situation is there so that many farmers have accounts in the local banks, but all the accounts are empty. In particular, in accordance with the information of the Institution of business development, after decrease of interests rates on deposits the confidence of the farmers to the banks reduced in catastrophic manner.

The peasants now prefer to act by methods related to natural economy. And also the banks do not invest willingly money into agricultural section. First, agriculture – it is object of crediting, connected with the high risk because of its dependence on factors which cannot be forecast. Second, the existing legislation limits the right to consider as collateral agricultural property, that is land. Absence of legislation of land finally influences not only on the sphere of mortgage crediting, but on many other factors of the market. However, if to speak about private property on land, it is hardly possible that after adoption of this law today to-morrow we will get high-developed market of mortgage crediting in agriculture. It is necessary to recall the example of Lithuania where in the period of government of Pruskene the land was distributed practically free of charge, however the peasants did not want to take it. It is possible that the reasons here are deeper, and even not legal or economic, but psychological . You know, before 1917 the secondary market of mortgage developed in Russia rather successively, however compulsory interruption of seventy years odd not only cancelled mechanism of its activity, but led to psychological negative attitude of people to possibility of undertaking any responsibility. It is absolutely that the above-mentioned has large meaning in the idea of organization of mortgage crediting, but it is more important in this relation realization of already adopted and confirmation of acts and decrees on home questions not adopted yet, because mortgage home crediting occupies leading positions in this section.

At the same time the laws, adopted by the State Duma “On mortgage”, “On state registration of rights for the real estate and transactions on them”, do not signify the large spreading in the regions of the country of civilized principles of mortgage crediting, because the financial credit institutions, the banks cannot independently resolve questions of assurance of liquidity in the case of long-term crediting.

This problem shall be solved with help of the institution of secondary market of mortgage credits, it is necessary to create special body, which issues securities, guaranteed by the government. The Association of mortgage banks from the first days of its organization works for organization of Federal Agency on home mortgage crediting, in which the role of the state from the point of view of participation and support is high especially on this stage of the beginning of civilized mortgage. It is expedient to consider the mortgage system organized by the government of Moscow.

3.2.1. The chart of mortgage crediting on the pattern of Moscow mortgage program.Taking into consideration the large concentration of banks, realty firms and other organizations on the real estate market in Moscow and the experience of financing of transactions with it, the local market of mortgages is organized in the city which will take part in the future in the federal market in the case of its organization.

The basis and the point of the beginning of realization of this idea can be the Decree of the city Government N365 from the 25th of April 1995 “On principles of mortgage crediting in Moscow”.

As we already noted, in the developed countries the organization and the regulation of mortgage market as a rule are effected by some state or private organization which acts on behalf or by order of the state, as for instance “Fenni May” in the USA. In Moscow the similar city organization is formed for realization of these functions under control of the Commission on securities – Moscow Mortgage Agency (MMA). /Appendix 1/

The Agency is formed as a municipal organization with the next gradual sale of its assets to private organizations. It works with narrow contact with the government of Moscow, under its direction and control. It participates in development of programs of financing of real estate market in Moscow, in development of securities market of the city, in their realization together with appropriate departments of the government.

The general purpose of MMA – assurance of mortgage crediting by financial resources and the guarantees of their return on mortgage loans, issued by the banks. There are the following functions, realized by the agency:

Purchase from banks of mortgage credits, forming in necessary cases of their pools and sale to other banks, insurance companies and other financial structures;

Realization and organization of issue and distribution of securities on credits bought from the banks;

Sale of the right of participation in credits on the base of agreement and forming of pools of mortgage credits;

Guarantee of return of means, issued by the banks in the form of loans in accordance with the programs of MMA;

Realization of certification of participants of mortgages secondary market ;

Development and realization of charts of mortgage crediting and secondary market in the limits of MMA;

Organization of preparation of skilled specialists on mortgage, preparation and realization of attestation of organization of participants of mortgage market in the city.

Mechanism of functioningThe bank which granted mortgage credit, sells it to MMA and by this method gets the possibility to grant this amount once more. The bank is obliged to service credit (collection of payments and alienation of property in the case of non-return of credit). The payments on the amount of credit are transferred through the bank to MMA. The amount of credit rate shall be divided between the bank (payment for service) and MMA (payment for resources).

In the case of resale of credit (MMA purchases from the creditor the credit and sells it to other bank) the cession of requirements shall be formed (article 380-382 of the Civil Code of Russian Federation, part 1). Primary creditor can serve such credit, who bears responsibility only for quality of service.

In the case of necessity of crediting of transaction on object of high value, when even large bank cannot (or does not want) grant loan, MMA forms credit pool for such amount. After purchase of the share of participant in the credit pool, bank buys the right for receipt of determined interest from the flow of earnings, received on credits, and also in proportion from it the rights for mortgage on credit. MMA issues and distributes for the amount of bought mortgage credits the securities, which have profitability equal to interest rate of credit less incomes of the bank and MMA. The securities have different periods of turnover and naturally different rates. For the purpose that the securities on mortgage were profitable for investor , their profitability shall be for some points above the profitability of the state securities. All securities of MMA have guarantees of the Moscow government.

MMA provides for the bank of creditor the return of amount of the credit granted by him. The borrower realizes monthly payments on credit to the bank-creditor in accordance with the schedule of payments, stipulated by credit agreement. The amount of return of indebtedness on credit is spent for covering the amount of securities of MMA. The bank transfers some part of credit rate , equal to income of the agency, stipulated in it, on its settlement account, and the balance is income of the bank. The difference of the time of securities redemption which have different period of turnover and issued on mortgage credits of several banks, and which have different time of payment on them , smoothes over the peaks of disparity of need and availability of credit resources of the banks participants of MMA and possible presentation to payment of securities. In the case of exceed of such resources the bank can participate in credits of other banks immediately or by purchase of securities of MMA, and on the contrary, in the case of their shortage, attract resources of other banks or sell securities to MMA.

The agency on separate pools of mortgage credits realizes their sale to other financial companies of Moscow and other cities and regions. Thus, from one side , rather free financial resources of participants of financial market will be attracted to Moscow, from other side, rather free for this moment financial resources of Moscow will be transferred to other regions for decision of problems of homebuilding and home purchase by population of other cities and regions.

At the present time the range of problems exists, which impedes development of mortgage crediting. The general instability of economy, low level of incomes of majority of population by comparison with the cost of dwelling, high taxes and inflation can be taken to the factors, which influence negatively on the development of mortgage.

But the most serious problem – it is insufficient help of the state in financial, organizational and legislative questions. The state in the countries with developed system of mortgage crediting, especially on the first stage, undertakes financial support of long-term crediting. The state support can be realized either with help of privileged taxation of the banks, constructors and other subjects, connected with the operations of construction financing or dwelling purchase, or with help of subsidies of the borrower. The organized help is necessary, first of all, for organization of the above-mentioned Federal Agency on mortgage crediting, which could buy from the banks credit obligations and issue securities under pledges, providing in this form the liquidity of mortgage credits.

ConclusionSumming up, it is necessary to note that the detailed consideration of such type of credit services as mortgage credit shows its big potential in Russian conditions. Russia – the country of enormous land riches and exactly mortgage of land, and also of fixed assets of many enterprises can provide means for transformation of production into the market conditions.

Mortgage crediting – to great extent new for our country type of banking services, and there are serious obstacles, which impede its development. The main obstacles are insufficient normative legal examination of the question, complication of attraction of long-term resources for mortgage, estimation of different types of risks and payment solvency of borrower.

All these problems impede considerably development of mortgage in Russia. However nobody doubts that it will be used in all parts in the future. That is why farsighted bankers try already now to understand this profitable and perspective niche, the more so as there is no serious competition on the present market. Even in the existing legal and economic situation several charts of mortgage crediting have been already developed, which permitted to realise these operations with profit and with minimum risk.

The possibility of using of mortgage for homebuilding crediting helps to decide not only the task of financial assurance, but also the sharp problem for Russia of dwelling.

Список литературыThe Civil Code of the Russian Federation, 1995

2. Federal law №. 102-FL of July 16, 1998 On Mortgage (Pledge of Real Estate)

3. Federal law of the Russian Federation №. 122-FL of July 21, 1997 On the State Registration of rights To real Estate and of Transactions with it

4. Federal Law №.135-FL of July 16, 1998 on Evaluation Activity in the Russian Federation

5. Decree of the President of the Russian Federation №. 293 of February 28, 1996 on Additional Measures for the Development of credit on Mortgage

6. Mortgage residence credit in USA, M.V. Boiko, 1998

7. Credit risk insurance, K.I. Bubnova, Realtor, n.3, 1998

8. Special German credit organizations, A.V. Kocharev, 1986

9. Fundamentals of mortgage credit organization, B.A. Kudrjavseva, 1998

10. Situation in Russian agriculture in transitional period, V.I. Nazarenko, State agricultural research institute, 1994

11. The beginning of mortgage in Russia, N.A. Proskurova, Mortgage- the finansing of future, n 3-4, 1995

12. Recommendations on Land market formation and using, N.A. Zhuravlev, Novosibirsk, 1994

13. The Appraisal of Real Estate, American Institute of Real Estate Appraisers, 1996

14. Land Law in action. The Swedish Ministry for foreign Affairs. Royal Institute of Technology. Sweden.

Похожие работы

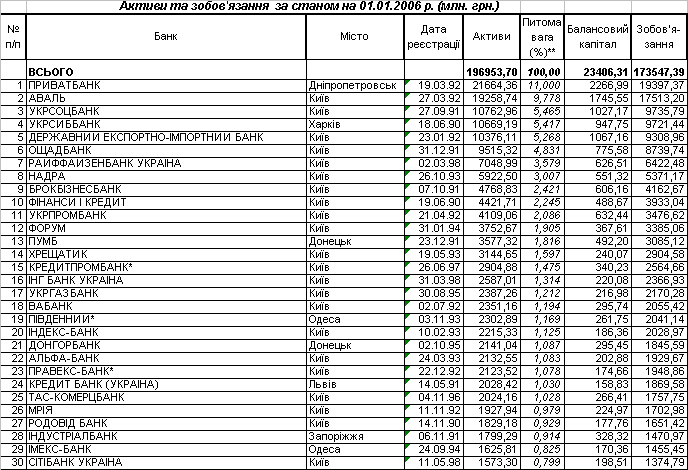

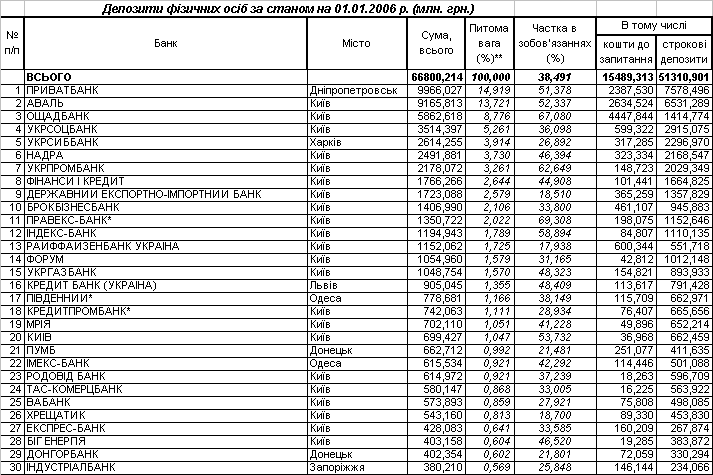

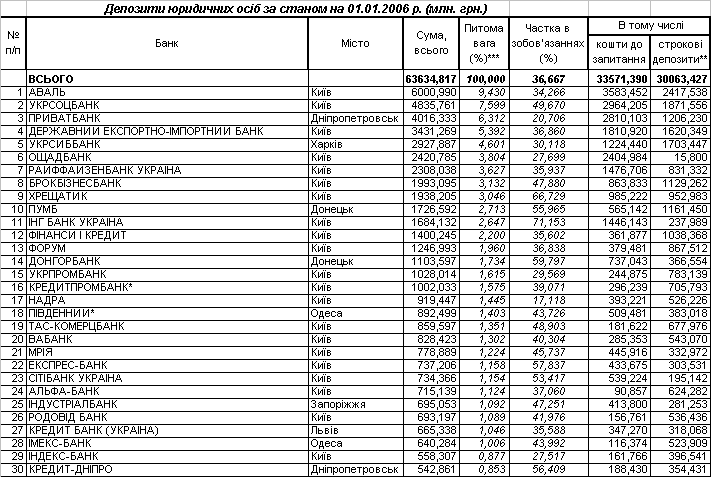

... є відносно малим (3% та 0,3% відповідно). В Додатку В представлені результати аналізу стану умов іпотечного кредитування фізичних осіб комерційними банками України 4. РОЗРАХУНОК БАНКІВСЬКОЇ РЕНТАБЕЛЬНОСТІ ДОВГОСТРОКОВОГО ІПОТЕЧНОГО КРЕДИТУВАННЯ 4.1 Аналіз структури та вартості ресурсних джерел для довгострокового іпотечного кредитування В якості довгострокових ресурсних оплачуваних джерел для ...

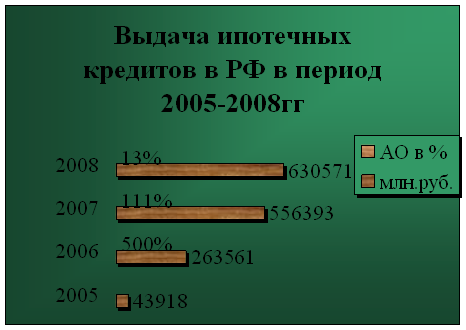

... страны, ее традициям. Для большинства стран решение жилищной проблемы является приоритетным, поэтому там всегда имеют место участие государства в ипотечной системе и различного рода льготы и гарантии. 4. Перспективы развития ипотечного кредитования в России Нынешний кризис – самый сильный со времен Великой депрессии прошлого столетия, и в той или иной степени он затронул все сектора ...

... amount of cash and cash-like assets—currency, coin, and bank balances. [6, p.642] When we refer to cash management, we mean management of cash inflows and outflows, as well as the stock of cash on hand. The primary players in the global money markets are banking and financial institutions which include investment banks, commercial banks, thrifts and other deposit and loan institutions. Banking ...

... озвончения в середине слова после безударного гласного в словах французского происхождения. Зав. кафедрой -------------------------------------------------- Экзаменационный билет по предмету ИСТОРИЯ АНГЛИЙСКОГО ЯЗЫКА И ВВЕДЕНИЕ В СПЕЦФИЛОЛОГИЮ Билет № 12 Дайте лингвистическую характеристику "Младшей Эдды". Проанализируйте общественные условия национальной жизни Англии, ...

0 комментариев